Ebook Sales Tax Florida

Florida fl sales tax rates by city.

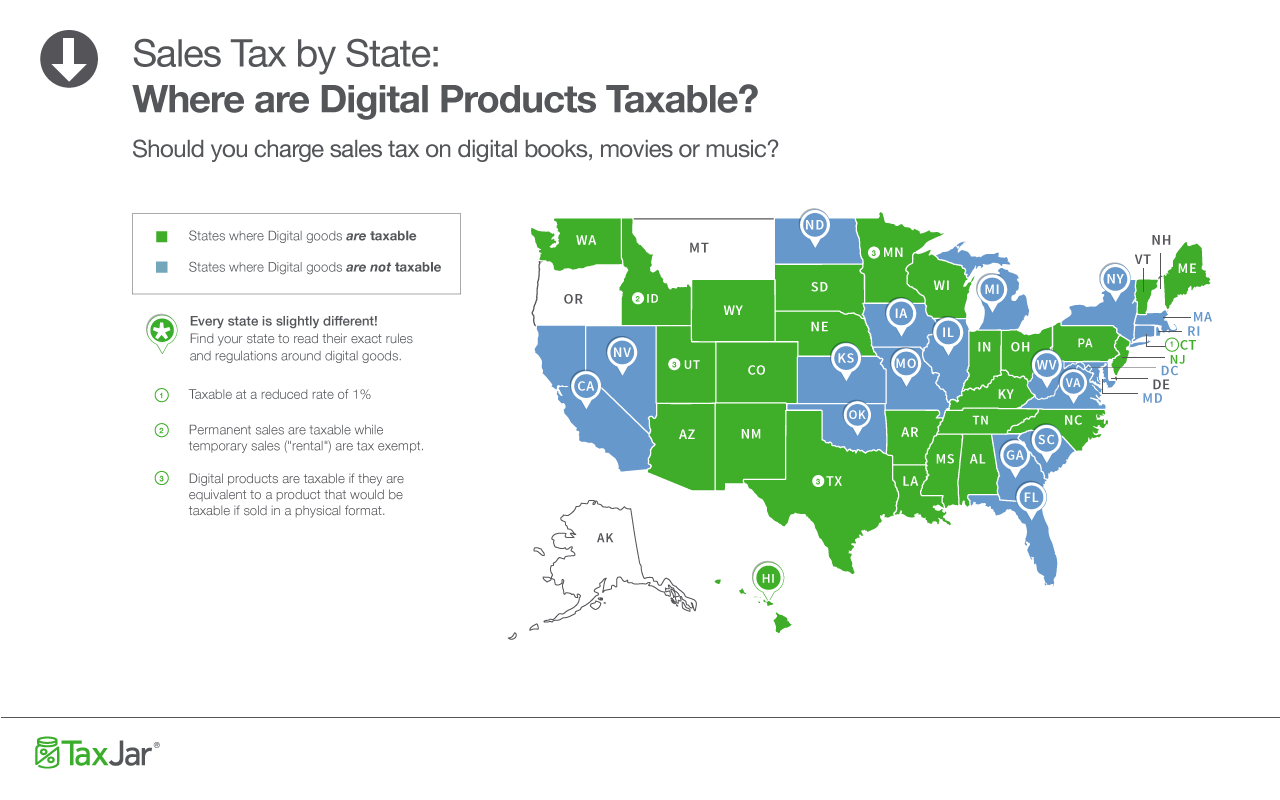

Ebook sales tax florida. Florida digital products are tax exempt in florida. 36 florida sales use tax issues specific to clubs were added to the december 2019 update. Software sales tax in the u s.

When it s time to file usually amazon won t withhold any of your ebook s earnings if you have a tax id or social security number so you re personally responsible for paying what you owe to the irs. Florida s general state sales tax rate is 6 with the following exceptions. In other words digital products are taxed in connecticut but not at the same sales tax rate as most other tangible personal property.

Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase. Currently almost half the states in the union apply sales tax to digital books downloaded music and even ringtones. 4 on amusement machine receipts 5 5 on the lease or license of commercial real property and 6 95 on electricity.

Club sales use tax book fl continues to be recognized by leaders throughout the florida private club industry as the one resource club managers controllers treasurers and professionals must have to keep them updated on the ever changing state sales use tax laws. With local taxes the total sales tax rate is between 6 000 and 8 500. Florida has recent rate changes sat feb 01 2020.

The florida state sales tax rate is 6 and the average fl sales tax after local surtaxes is 6 65. Modas created a free ebook to help explain software sales tax and understanding nexus the obligation to collect sales tax based on sales activities to tax exemption and collecting remitting sales tax. Florida has 993 special sales tax jurisdictions with local sales taxes in addition to the state.

Counties and cities can charge an additional local sales tax of up to 1 5 for a maximum possible combined sales tax of 7 5. Every 2020 combined rates mentioned above are the results of florida state rate 6 the county rate 0 to 2 5. Instead they are taxed at the same rate as other computer and data processing services.